These Men Made Up a Country to Steal Millions of Dollars

Some people will do anything to make a quick buck, but four men took their deception to new levels while trying to steal millions of dollars in COVID funds.

The men participated in an elaborate $11.5 million con that involved creating a non-existent country in hopes of raking in millions of dollars in pandemic relief funding. Collectively, the men face an 18-count indictment before a federal grand jury with charges that include conspiracy to commit fraud, mail and wire fraud, and money laundering.

The Men Had Multiple Aliases to Set Their Plan Into Motion

The men set up a fraudulent consulate in Milwaukee and used the fake country of Al Moroc to claim a series of benefits during the COVID-19 pandemic.

Source: Sean Gallup/Getty Images

One of the men involved in the scheme is from Milwaukee while the other three are from Illinois. Aziz Hassan Bey, also known by his alias Chauncey Hooks, conspired with Letez Osiris Bey, also known as Devone Robinson, Minister Zakar Ali, whose alias is Anthony Allen, and Divine-Seven El, also known as Mark Nesbit.

They Applied for Funding From Two Government Programs

The suspects targeted two federal relief programs intended to help businesses stay afloat during the pandemic. According to prosecutors, the men applied for funding through the Economic Injury Disaster Loan program and the Paycheck Protection Program.

Source: H. Armstrong Roberts/ClassicStock/Getty Images

The men successfully managed to pilfer over $11 million from their scheme from June 2020 until July 2021. Evidence indicates that the men falsely claimed that the imaginary Consulate of Al Moroc was incorporated in 2018. Aziz Bey was listed as the registered agent and director for the alleged consulate office.

PPP Loans Were Meant to Aid Businesses During the Pandemic

With the pandemic shutting down most of the economy for months at a time, many American businesses were faced with the threat of closing for good.

Source: Yahoo Finance/YouTube

In an effort to help businesses stay up and running while society was at a standstill, business owners could apply for funding through the Paycheck Protection Program, also known as PPP loans. The loans were designed to help business owners pay their employees during the COVID-19 crisis. These loans played a pivotal role in keeping the American economy in good standing while business owners struggled to get by. Unfortunately, not everybody who applied for PPP loans and other pandemic-related funding was honest in their intentions.

A Trail of Lies and Dishonesty

A government official from the State Department testified in court that Al Moroc is not a real country recognized by the U.S.

Source: Harold M. Lambert/Getty Images

To add further credence to their case, prosecutors presented evidence that the address used for Al Moroc is a duplex in Milwaukee. Prosecutors also charged three of the men with falsifying records that they submitted to the state. According to prosecutors, this was done to defraud lenders “by removing liens from the titles of luxury cars they owned.”

The Money Was Spent on Frivolous Things

Prosecutors assert that the scam allowed the men to clear liens from their vehicles including a Corvette, a BMW, and a Land Rover.

Source: Edmunds

“As a result of the defendants’ false and misleading statements and omissions, the Wisconsin Department of Motor Vehicles issued titles to A. Bey and the Consulate for multiple vehicles free and clear of any liens held by lenders,” said the indictment. Not only did prosecutors accuse the men of carrying out such an unthinkable crime but they also showed that the men purchased luxury items with the fraudulent funds they acquired.

How Were They Able to Fake It?

It’s safe to assume that the government would immediately catch on to a fake country filing for millions of dollars in pandemic loans, but that just wasn’t the case.

Source: H. Armstrong Roberts/Getty Images

Aziz Hassan Bey, Letez Osiris Bey, Minister Zakar Ali, and Divine-Seven El all forged documents that claimed Al Moroc was a legitimate nation. The men went to great lengths to ensure that they could profit from their scheme. Of course, filing false documents with the federal government is not a wise thing to do and eventually, they were busted.

Prosecutors Have a Strong Case Against the Men

While COVID relief money was meant for people who truly needed it, the foolish foursome spent hundreds of thousands of dollars on superficial items such as jewelry and cars.

Source: William Thomas Cain/Getty Images

“The jury’s verdicts reflect the fact these defendants sought to enrich themselves at the expense of taxpayers,” said U.S. Attorney for the Eastern District of Wisconsin Greg Haanstad. Prosecutors argued that the men stole valuable funds from people who relied on it during a critical time of need. “In addition to fraud targeting private businesses, they sought to take unlawful advantage of programs meant to help individuals, businesses and the entire economy survive the impact of the pandemic,” said Haanstad.

Their Lies Have Finally Caught Up With Them

The four men received millions of dollars in federal loans on the condition that the Consulate of Al Moroc was a real country.

Source: H. Armstrong Roberts/ClassicStock/Getty Images

However, it has become quite clear that the defendant’s ability to lie has no limits and that the country had been completely fabricated. In the indictment, prosecutors said that they submitted “loan applications that contained materially false representations” and even claimed that they owned “functional and operational businesses.”

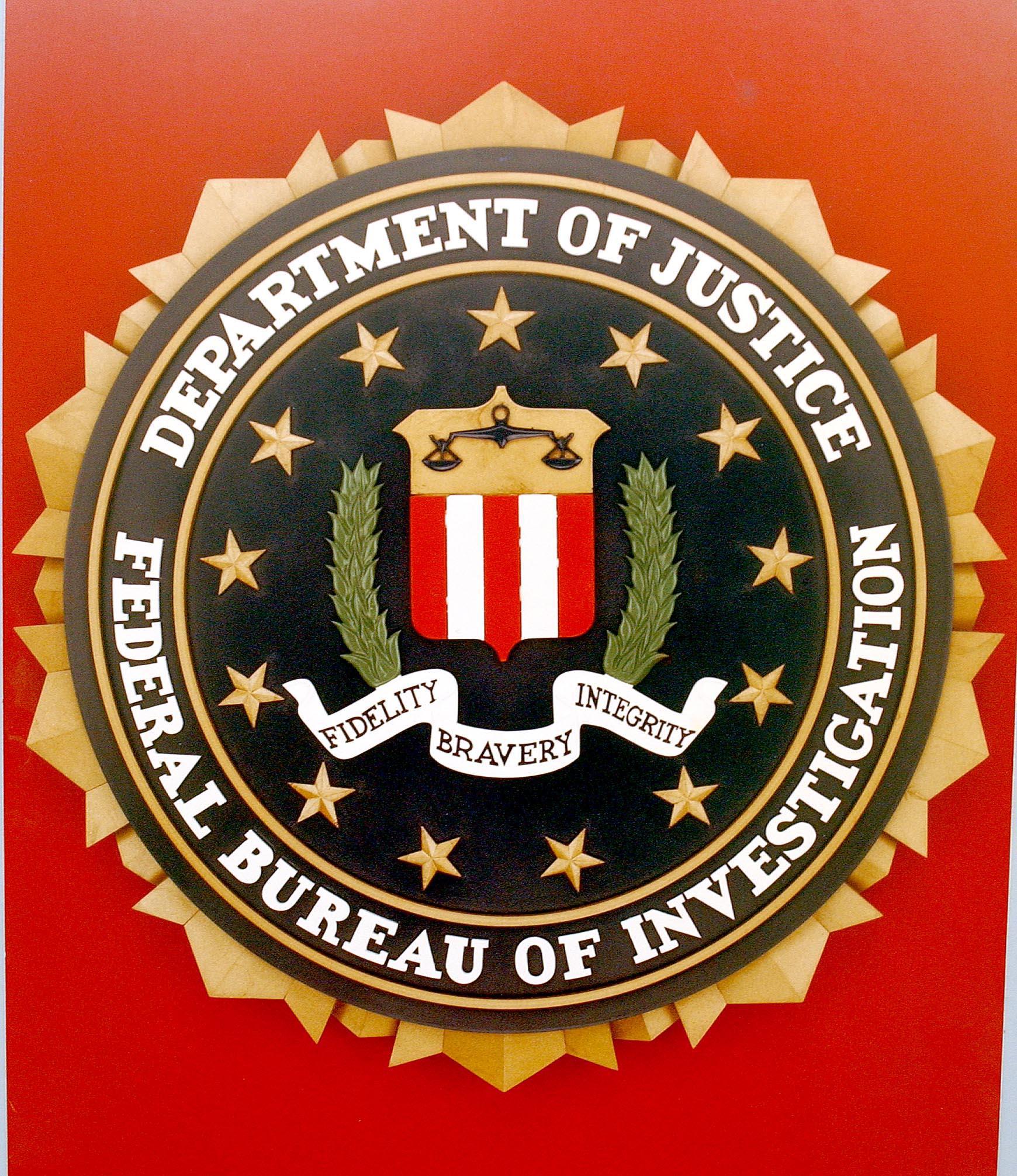

The FBI Put an End to the Criminal Activity

While the men managed to get away with their con for over a year, they were finally caught in the act.

Source: Greg Mathieson/Mai/Getty Images

“This fraud scheme was dismantled through excellent collaboration between the FBI and our law enforcement partners,” said FBI agent Michael E. Hensle. He spoke of the FBI’s “unwavering commitment to combat fraudulent activities” such as the ones the four men engaged in. Hensle ensured that they, along with anyone else who commits a similar crime, will be “held accountable” for their actions.

They Are Facing Serious Consequences

The men falsified countless documents and submitted them to the federal government for funding.

Source: Mark Wilson/Getty Images

On their loan applications, they falsely indicated that the “loan proceeds covered business expenses,” when they used the money to enrich themselves. To make matters worse, the men took their scheme to new heights by including “false figures of the businesses’ number of employees, monthly payroll expenses, gross revenues and costs of goods sold.”

How Much Jail Time Will They Get?

The troubles don’t stop there for the four convicted men. They have also been charged with defrauding the U.S. Small Business Administration after illegally obtaining a $775,000 payment.

Source: Giles Clarke/Getty Images

The men are currently in custody as they await sentencing by United States District Judge J.P. Stadtmueller on February 1, 2024. They are each looking at significant time behind bars. They face up to 20 years in jail for conspiracy and mail and wire fraud convictions, and an additional 10 years for money laundering. They are also facing up to five years of supervised release.